Debit Card Security

New fraud detection features: With our new Debit Card Management widget, you can keep your card safer than ever by signing up to receive security alerts for declined transactions and transactions over a dollar amount of your choice. You can also freeze your card to automatically decline purchases in case of loss, theft, or fraud. And as always, if a suspicious purchase is made using your card, we’ll alert you via text and ask you to verify that purchase. Learn more about how to customize your card security.

How we protect you

Your protection is our top priority, so we invest in countless resources and security features to keep your information safe.

- A dedicated fraud team monitors your accounts for suspicious activity.

- If a suspicious purchase is made using your debit card, you will be alerted via text message and asked to verify that purchase.

- Daily debit card limits are in place for cash withdrawals and purchases.

- Debit card transactions are declined with merchants identified as high fraud risks.

- International transactions are restricted on debit cards unless authorized by account holder.

- A 24-hour contact center is available if your card is lost or stolen. The phone number is located on the back of your card. We recommend adding that number to your phone contacts.

- If your debit card is lost or stolen or you suspect fraud, immediately freeze your account using our Debit Management Tool.

How you can protect yourself

- Check for card skimming devices before using any ATM or gas pump. Here’s how to check.

- Look at reviews and Better Business Bureau status before purchasing on unfamiliar sites.

- Shred unneeded documents that contain your card information.

- Cover the keypad when entering your PIN.

- Avoid sharing your card or its information with anyone.

- Memorize your PIN instead of writing it on the card.

- Set up Card Activity Alerts through Connexus Digital Banking to get notified when a purchase is made from your debit card.

Protect your card in three, easy steps.

Register for Digital Banking

With Digital Banking, you can track recent activity and set up notifications to alert you when your card is used.

Report a card

If you suspect fraud, lose your card, or need to report it stolen, call us immediately so we can put a hold on your account.

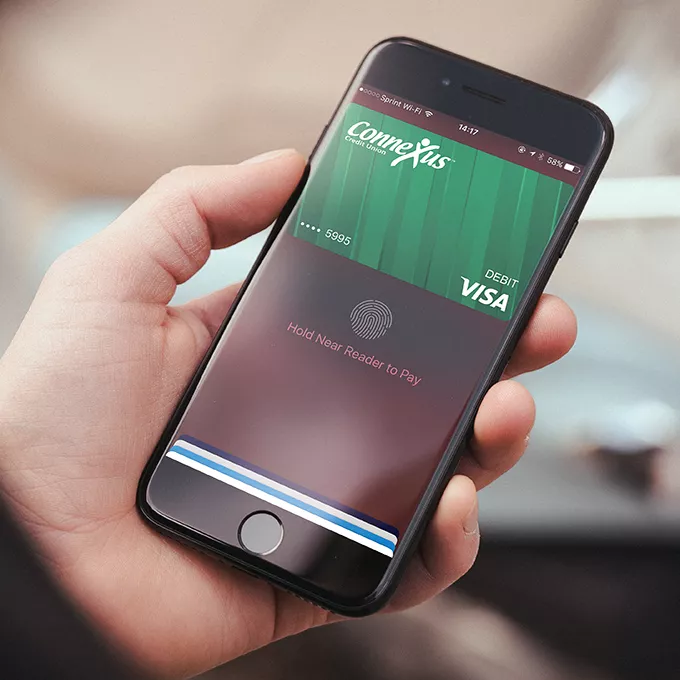

Use a Mobile Wallet

Using Apple Pay®, Samsung Pay®, or Google Pay™, keeps your card information from being shared with merchants.