eDocs

Electronic statements, tax forms, and account notices — all at your fingertips.

What documents are stored in eDocs?

eStatements

Don’t worry about storing paper statements. You can view up to 18 months of past eStatements in eDocs.

eTax Forms

At the end of the year, any tax forms you receive from Connexus will be safely stored in eDocs.

eNotices

When certain activity happens in your account, we will notify you of it online, rather than in a traditional mailing.

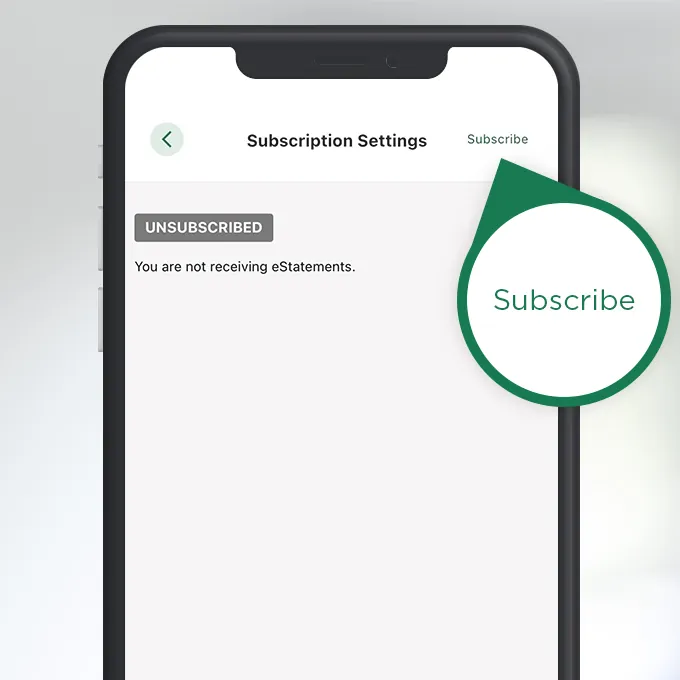

How to Subscribe to eStatements

If you’re registered for Digital Banking, subscribing to eStatements only takes three steps. Once subscribed, you will also begin receiving your Connexus tax forms and eNotices in eDocs.

- Log in to Digital Banking.

- Under the My Accounts menu, click “Statements & eDocs.”

- Click “Settings” and “Subscribe.”

Why online documents are better than paper documents

On-the-go access

Storing your statements, tax forms, and account notices online in one place makes them easy to view at any time on your smartphone.

Better for the environment

Go green by using less paper. Help us support the environment by choosing online statements and electronic notices.

Faster than paper

Instead of waiting for your statements, tax forms, and account notices to arrive in the mail, get them immediately online.

Take Connexus on the go

Download the Connexus App1 on your phone or tablet!

FAQs: You asked. We answered.

Disclosures

- Connexus Mobile app is available for Apple® or Android™ mobile devices. Message and data rates apply. Funds are available within two business days after date of deposit, unless otherwise noted. Deposit limitations apply. Visit www.ConnexusCU.org for terms, conditions and details. Apple® and the Apple® logo are trademarks of Apple® Inc., registered in the U.S. and other countries. App Store® is a service mark of Apple® Inc. Android™ and Google Play™ are trademarks of Google™ Inc.