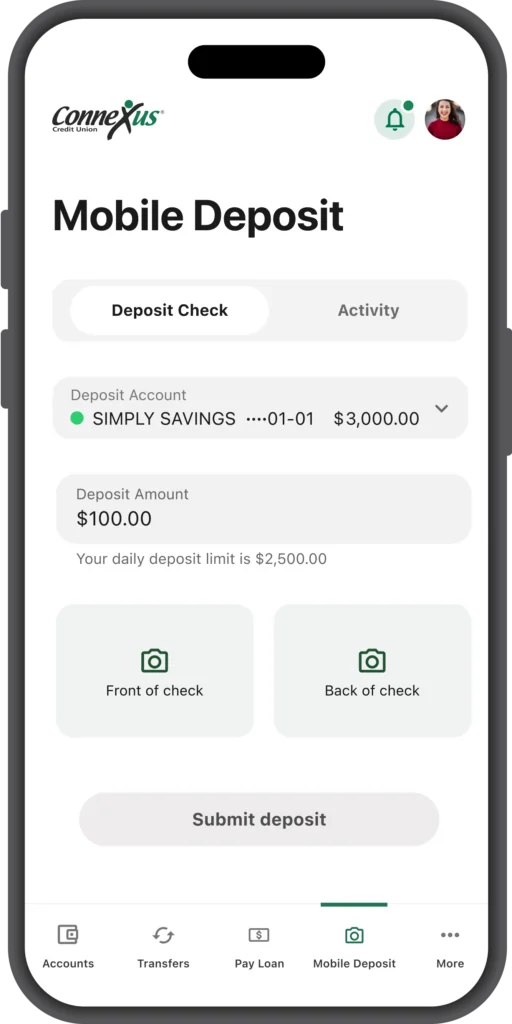

Mobile Deposit

Deposit paper checks using your smartphone.

Sign, snap, and deposit checks. Anytime, anywhere.

Don’t fight traffic or drive-thru lines to deposit checks in person. Save time by using Mobile Deposit to quickly and easily deposit checks using your smartphone in just three, simple steps.

How to use mobile deposit

Step 1

Sign the back of the check and write “For Mobile Deposit Only at Connexus Credit Union”. Then log in to the Connexus App and tap “Mobile Deposit” from the menu.

Step 2

Tap the account you’d like to deposit your check into. Then tap “Deposit amount” and enter the dollar amount you’d like to deposit.

Step 3

Tap “Front of check” to take a picture of the front of the check and “Back of check” to take a picture of the back of the check. Then tap “Submit deposit.”

Take Connexus on the go

Download the Connexus App1 on your phone or tablet!